NEWS

HOT ITEM

Recent News

Scholarship Winners | 2025April 24, 2025 - 10:47 am

Scholarship Winners | 2025April 24, 2025 - 10:47 am 2024 Indiana Kentucky Graduate Speaker – Kyle HarveyMarch 28, 2025 - 1:49 pm

2024 Indiana Kentucky Graduate Speaker – Kyle HarveyMarch 28, 2025 - 1:49 pm Military Outreach Makes Big ImpactMarch 24, 2025 - 3:29 pm

Military Outreach Makes Big ImpactMarch 24, 2025 - 3:29 pm 2025 Central Midwest Sisterhood UpdateMarch 3, 2025 - 5:13 pm

2025 Central Midwest Sisterhood UpdateMarch 3, 2025 - 5:13 pm Craft Spotlight – Justin RogersFebruary 26, 2025 - 4:44 pm

Craft Spotlight – Justin RogersFebruary 26, 2025 - 4:44 pm Ohio’s Newest Journey-Level Carpenters: Class of 2025February 25, 2025 - 12:55 pm

Ohio’s Newest Journey-Level Carpenters: Class of 2025February 25, 2025 - 12:55 pm Craft Spotlight – Brandon HuffmanFebruary 19, 2025 - 3:26 pm

Craft Spotlight – Brandon HuffmanFebruary 19, 2025 - 3:26 pm

Carpenters Support Down Syndrome Awareness Event

/0 Comments/in News /by IKORCCDan Sivertson, member of Millwrights & Pile Drivers 1090, and his family have a special reason they celebrate World Down Syndrome Day. He and his wife found out their daughter would be born with Down Syndrome 13 years ago. The two quickly made a connection with the local organization, The Up Side of Downs. The organization helped by providing them with support in learning about Down Syndrome and with books to guide them through the diagnosis.

He and his wife found out their daughter would be born with Down Syndrome 13 years ago. The two quickly made a connection with the local organization, The Up Side of Downs. The organization helped by providing them with support in learning about Down Syndrome and with books to guide them through the diagnosis.

The Up Side of Downs truly made an impact in their lives and they are forever grateful for the support. Their daughter Eve is now 13 years old thriving in the 7th grade. Eve is just like any other teenage girl and loves the time she spends with her friends!

In celebration of World Down Syndrome Day, the IKORCC would like to shine a light on an organization we take pride in supporting. The IKORCC was fortunate to be a Presenting Sponsor for The Up Side of Downs Gala/Raffle event on Saturday, March 10th for the fifth year in a row.

Between Carpenters Locals 373, 435 and Millwrights and Pile Drivers Local 1090 we have donated over $50,000 to the organization to help raise awareness and advocate for people with Down Syndrome. Over 570 people attended the Up Side of Downs Gala, 120 of them were IKORCC members.

If you interested in supporting the cause, there is a Buddy Walk on August 25th. Last year there were over 5,000 plus attendees at the event. Dan Sivertson in a leader of the beli-EVE N US Team and typically has around 75-100 family and friends walk together for the cause.

Indianapolis Mayor Joe Hogsett Helps Fight Tax Fraud

/0 Comments/in Indiana Activism, News /by IKORCCIn March, Indianapolis Mayor Joe Hogsett visited the IKORCC to discuss the growing issue of tax fraud and the effects it has on responsible contractors, the city, and taxpayers.

the city, and taxpayers.

Tax fraud occurs when companies misclassify workers who should be employees in order to avoid paying their fair share of unemployment insurance and federal, state and local taxes. Companies that commit tax fraud are often able to give lower bids on projects since they aren’t paying their share of taxes – a practice which makes it difficult for responsible contractors to compete fairly.

“Everybody ought to have the right to compete fairly,” Mayor Hogsett said while addressing contractors. “I want to be clear – what the city seeks to do is not to pick winners and losers. Our job is to make sure everyone is operating on a level playing field,” Hogsett added.

Mayor Hogsett also acknowledged that the IKORCC has been at the forefront of the battle against tax fraud. “The carpenters have really taken a leadership role in this regard,” he said.

In response to the growing tax fraud problem in the construction industry, Mayor Hogsett says he put together a working group to explore the ordinances in place within the city and the means of enforcing these policies. “The ordinance is a bit vague in the enforcement area,” he said, adding that he hopes to have an enforcement officer in place in the future to cut down on tax fraud.

The IKORCC has seen an increase in the prevalence of tax fraud in Indiana, Kentucky, and Ohio and hopes to work with Mayor Hogsett and the working group to help curtail the issue.

Click here to learn more about tax fraud.

Walker Career Center’s Future Tradesmen

/0 Comments/in News /by IKORCCThe Warren Central Walker Career Center is advancing their students to successfully become tradesmen in the near future. Council staff Jeff Gielerak and Steve Hoyt are graduates of the Warren Central program and were happy to share about the opportunities available at the IKORCC and contribute $250 to new tools for their program. The Senior students were excited about their future and had several questions regarding our union. While visiting, Steve and Jeff were able to explore a home the students are currently working on.

Council staff Jeff Gielerak and Steve Hoyt are graduates of the Warren Central program and were happy to share about the opportunities available at the IKORCC and contribute $250 to new tools for their program. The Senior students were excited about their future and had several questions regarding our union. While visiting, Steve and Jeff were able to explore a home the students are currently working on.

“It’s great to see the students working hard on their project the day before Spring Break!” Steve says, adding, “That’s what we need out on our job sites.” The students will be working tirelessly on completing the project for the first open house this coming May.

Apprentice Finds Career & Stability with Carpenter’s Union

/0 Comments/in News /by IKORCCDave grew up in a strictly non-union family, never truly seeing the benefit of belonging. But when times were tough and his brother Steve Morrow of Local 200 joined the United Brotherhood of Carpenters and found success, Dave decided it was time to change his trajectory too.

The small leap he took to join the union, made a huge difference in his family’s life. Today, Dave Morrow is a 3rd year carpenter apprentice with a promising future. Work is steady, school is going well and Dave recently completed four days of intensive training at the Carpenter’s International Training Center in Las Vegas, Nevada.

Apprenticeship Leadership Training Program

For Dave, the highlight of the training was a group discussion with UBC President Doug McCarron. “McCarron didn’t talk to us, he talked with us. This is a man who didn’t forget his roots or where he came from. It was inspiring,” Dave says.

In addition, Dave says he learned a great deal about the union and his own regional council the IKORCC. “I learned that it takes teamwork, hard work and dedication to get this union back to where we once were,” Dave says, adding that he left Las Vegas feeling inspired, motivated and ready to build a brighter future for his family and brotherhood.

“It starts with us – the apprentices. We part of something much greater than construction,” he added.

Union Focus on Career and Family

Dave took his new leadership skills back to the job, where he’s worked for two years. He’s found a new sense of job security and a career that allows him to spend more time with his wife and two young children.

“If you come in and do your job well, you will have work.” Dave says, adding, “I get to be home with my family on the weekends – it’s great.”

Dave Morrow is a proud member of Carpenter’s Local 200 in Columbus, Ohio.

Click here more information on our apprenticeship programs or trades.IKORCC & JATC Add 222 New Journeymen to the Workforce

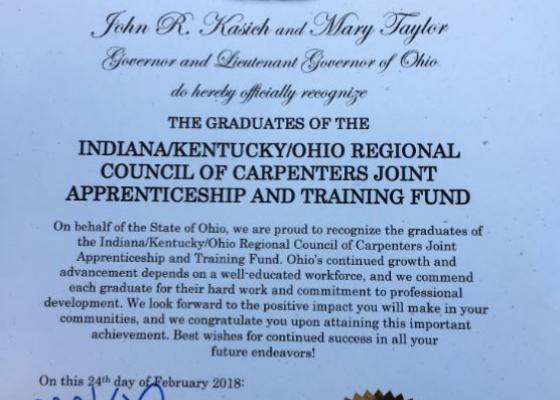

/0 Comments/in Diversity, News /by IKORCC5200 hours of on the job training, 640 classroom hours, 4 years of dedication and sacrifice – that’s the kind of experience you get when you hire a union journeyman. Saturday night, 222 fully trained journeymen and women graduated from the JATC & IKORCC apprenticeship program in Columbus, Ohio.

Saturday night, 222 fully trained journeymen and women graduated from the JATC & IKORCC apprenticeship program in Columbus, Ohio.

The graduates are a vital addition to a workforce desperate for skilled tradesmen. Graduates were trained as carpenters, millwrights or floor coverers.

Building America with Skilled Trades

In a speech to graduates, Patrick Reardon, Executive Administrator of Apprenticeship for the Ohio Office of Workforce Development, said IKORCC carpenters are building our future.

“When we think of an elite carpentry workforce here in the United States – it’s everyone graduating in this room,” he said. “Everyone here is building America and we are relying on you to continue to catapult us to the future.”

16 Veterans Graduate through Helmets to Hardhats

State Training Director Vince Wright said, “Thousands of veterans come home to Ohio each year and need new jobs and careers to get started in. I’m proud to say out of our 2,200 apprentices, we have 216 Helmets to Hardhats apprentices.”

Colonel Mark J. Cappone, Assistant Director of Ohio Veterans Affairs, said, “Tonight is a great way to remember the contributions that our vets make to the workforce, to remind us that those who have served have grit, determination, perseverance and they know how to be on a team.”

have served have grit, determination, perseverance and they know how to be on a team.”

Colonel Cappone presented a sealed recognition of the apprenticeship program on behalf of Ohio Governor John Kasich at the event. Governor Kasich commended the graduates for their hard work.

Continuous Training Sets Union Carpenters Apart

IKORCC Executive Secretary-Treasurer Mark McGriff also commended the graduates, while offering advice for the future. “When writing the story of your life, make sure no one else is holding the pen,” he said.

“There are so many opportunities in this organization, you have to take advantage of every single one of them,” McGriff added. McGriff and other staff members encouraged new journeymen to keep up with continuous training and serve as role models for apprentices.

A New Generation of Journeymen

New graduate Jacob Weiser, from the Northwest JATC and Local 351, plans to do both. Staff chose Weiser to speak at graduation after recognizing his dedication. “I’ve learned the importance of this apprenticeship and why the training is necessary to push our union and our trade forward,” Weiser said.

Weiser added, “I’m going to keep learning and keep trying to find better ways to get things done. I’m going to give my contractor what he’s paying for – a solid eight hours of carpentry, from a well-trained union journeymen carpenter.”

Congratulations to all graduates!