Andrew Steele andrew.steele@nwi.com, 219-933-3241

Sep 3, 2017 Updated Sep 8, 2017

As companies strive to increase profits amid a changing economy and consumer habits, the discussion often centers on challenges posed by the “gig economy” and its impact on work and employment.

Upstart companies like the Uber ride-sharing service tend to be the focus of concern; recent reports of such companies’ drivers speaking out against perceived company efforts to trim their pay bear this out.

Online story on NWI Times

But the growing use of short-term contracts in industries such as construction is threatening traditional employment in a way some say has reached a critical phase.

The fight is over what’s commonly called “employee misclassification” — or payroll fraud, in the view of unions and contractors. It involves an employer hiring workers as freelancing contractors who should be full-time employees, thereby allowing the employer to avoid paying payroll taxes, and worker’s compensation and unemployment insurance premiums, among other costs.

“It’s a problem that’s been around for many decades,” said Dewey Pearman, executive director of the Construction Advancement Foundation of Northwest Indiana. “But it’s becoming epidemic.”

Officials with the Indiana/Kentucky/Ohio Regional Council of Carpenters visit job sites frequently to talk to carpenters, said Scott Cooley, senior representative at the union’s local headquarters. He said he often talks to contract workers who he believes should be formal employees.

“We run into it all the time,” Cooley said. “It’s just a regular occurrence.”

Some workers in question receive a federal 1099 form at the end of the year, but others aren’t reported at all, and are just paid cash for their work.

‘No magic’ in defining employment

Classifying employees properly isn’t an exact science. It involves several variables, including the degree of company control over the employee; the financial arrangement, including who provides tools and supplies; whether there are benefits such as a pension and insurance; and whether work performed is a key component of the business’ activity.

The Internal Revenue Service lists 20 factors to consider, and states in its guidance on the matter that “there is no ‘magic’ or set number of factors that ‘makes’ the worker an employee or an independent contractor.”

But contractors and the carpenters’ union say some building projects are rife with contract workers who clearly are misclassified: their hours and duties are assigned by their employer, their tools and supplies are provided, and their work is a core function of the company — all factors that generally make one an employee, not a contract worker, in the eyes of the law.

Quantifying the problem

A 2010 study commissioned by the Indiana Building & Construction Trades Council and the Indiana, Illinois, Iowa Foundation for Fair Contracting argued that a company’s use of these workers gives employers who use the practice a decided, but unfair, competitive advantage.

The report, by economists from the University of Missouri-Kansas City, estimated 72,299 employers, 8,052 of them in construction, had misclassified employees in 2008. It said 15.3 percent of employees were misclassified, totaling 377,742 workers, of whom 24,323 were in construction.

The practice also has implications for governments at all levels, the study found. For the state in 2008, $30.4 million in unemployment insurance taxes were lost, $2 million of that from the construction industry.

Between $134.8 million and $224.6 million of income tax revenue went unpaid, with $10.6 million from the construction industry.

Local income tax losses statewide totaled $91.2 million, $7.2 million of that from the construction industry, according to the study. Also, $26.3 million of worker’s compensation premiums were not properly paid, with $4.6 million of that from construction, according to the report.

Ultimately, the University of Missouri report estimated the costs to the state of Indiana, at a high end, of about $406 million annually.

But a precise evaluation of the cost to government is elusive. Several state agencies charged by the state’s Pension Management Oversight Commission with doing a study of their own in 2010 disputed the methodology and assumptions of the university study.

They estimated 8 percent of workers, not 15.3 percent, are misclassified, and that the state loses $14 million to $20 million annually in tax revenue, “of which (the Department of Revenue) could be expected to recover a substantial portion.”

The report, by the state departments of Workforce Development, Labor and Revenue and the Workers’ Compensation Board, also questioned the impact on the workers’ compensation and unemployment insurance system.

Finally, the report’s writers argue that misclassification often is an innocent misunderstanding of the law. “Heavy-handed penalties will have little impact on these employers,” the report concluded.

But contractors and unions dispute these conclusions, saying the effect on their work is clear and stronger enforcement is key. When a state legislative study committee investigated the issue last year, more than 40 contractors wrote letters contending that the misclassification problem has grown to the point that it threatens the viability of construction companies that abide by the rules.

The companies included Northwest Indiana’s Berglund, Gough, Larson-Danielson, Precision, Prodigy, Solid Platforms, Specialty, Superior, and Pangere.

Misclassification “gives cheating contractors a 30 percent advantage in bidding, undermining the legitimate contracting community through low-ball bids that do not represent the cost of conducting lawful business,” wrote Timothy Larson, president of Larson-Danielson Construction Co.

Enforcement elusive?

The carpenters’ union recently had success when it filed a complaint with the National Labor Relations Board regarding a LaPorte hotel under construction. The complaint alleged that misclassification of workers impeded their ability to act collectively and form, or join, a union.

The complaint resulted in a settlement requiring the contractor to reclassify the employees and to inform them of their rights under federal law. But union officials called that settlement “a slap on the wrist” and, along with the contractors, have urged greater enforcement.

“There are laws on the books right now; the problem is they’re not enforced,” Cooley, of the tri-state carpenters’ council, said.

Efforts on the state level have included a law that took effect in 2010 requiring the Labor, Workforce Development and Revenue departments, along with the Worker’s Compensation Board, to share information on possible worker misclassification in the construction business.

The state also maintains an email address to receive tips, wagehour@dol.in.gov.

But further efforts to bolster enforcement have met with resistance, according to the state senator behind a bill proposed in the last session.

“We’ve got all these different departments, and they’re supposed to share this information, but it doesn’t always happen,” said Sen. Karen Tallian, D-Ogden Dunes.

Tallian authored a law that would have created a Payroll Fraud Task Force made up of representatives of the four state agencies. The law would have required hiring an investigator dedicated to investigation and enforcement. The bill had one committee hearing but never received a vote.

“We recognize there’s a problem. We just don’t know how big the problem is, and we don’t know for sure how to fix it,” said the Pensions and Labor Committee chairman, Crawfordsville Republican Phil Boots, when he concluded the Feb. 1 committee hearing on it.

Tallian said the state government has downplayed the problem and the state agencies’ potential to address it.

“It keeps getting worse,” Tallian said. “This bill will be filed again. We’re going to keep pushing it.”

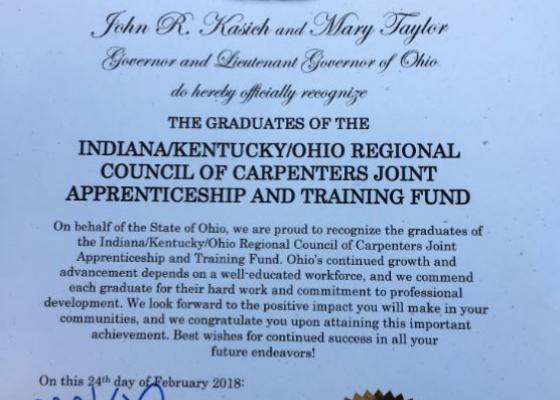

Saturday night, 222 fully trained journeymen and women graduated from the JATC & IKORCC apprenticeship program in Columbus, Ohio.

Saturday night, 222 fully trained journeymen and women graduated from the JATC & IKORCC apprenticeship program in Columbus, Ohio. 16 of the graduates honorably served in our nation’s military and took part in the IKORCC’s Helmets to Hardhats program. Helmets to Hardhats puts vets on a fast track to union apprenticeship and a rewarding career in carpentry after their military service.

16 of the graduates honorably served in our nation’s military and took part in the IKORCC’s Helmets to Hardhats program. Helmets to Hardhats puts vets on a fast track to union apprenticeship and a rewarding career in carpentry after their military service. have served have grit, determination, perseverance and they know how to be on a team.”

have served have grit, determination, perseverance and they know how to be on a team.”